As students, either your parents have afforded you the luxury of owning a car, or you have worked very hard while completing your studies (we’re proud of you boobie) to buy your own vehicle. Either way, it is very important that you are aware of the risk factors and uncertainties that one may face before buying a car.

Firstly, cars are the only material objects that cost an arm and a leg but depreciate as the days go by. “I’m going to invest in a car” Said no-one ever! However, in Jozi especially, it is very hard to get by without a car as public transport.

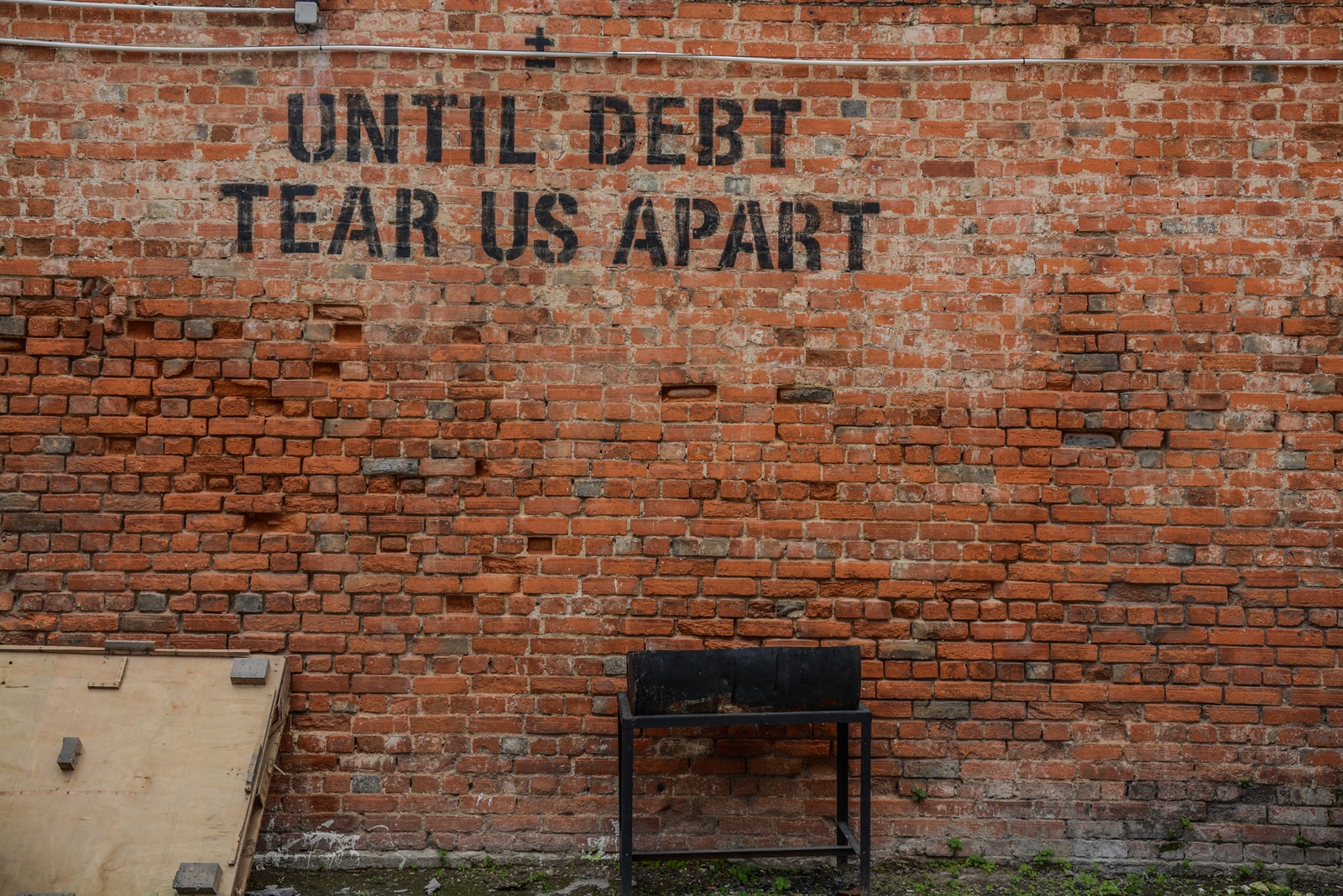

While the only thing worrying you at the moment might be whether your car loan will be approved by the bank, there are other key factors you should also consider. No one knows what the future holds, so you need to be prepared for whatever might come your way, so you don’t get trapped in a cycle of high interest debt.

If you guys are in the market for a new car, you should rather budget for more than just the purchase price and running costs. Being prepared for change – whether it’s planned or not – is a worthwhile exercise. This is one of the reasons that WesBank advises all car buyers to buy well within their means, and leave room in their budgets for savings and unexpected expenses. Amen Wesley!

“Always look at your car purchase as a time frame. WesBank’s data shows that more consumers are choosing to finance their car over 72 months (six years). So you need to ask yourself what might happen during that time that could affect your budget or choice of car,” says Rudolf Mahoney, Head of Brand and Communications at WesBank. Life comes with unexpected turns and no-one is aware of what the future may bring, with that being said these are some life changing events that car buyers need to ponder about before making the impulsive decision on buying a vehicle that they cannot actually afford:

A growing family

When you bought your car, you may have been single and decided a two-door sports car was the hot-rod for you. Two years out of Varsity, you are starting a family and it has just dawned on you that a baby seat isn’t going to fit in the space where your sound system lives. Or perhaps you meet someone who already has a child or two – and you decide to blend families. Life has changed and you may need to look at selling your sports car to buy a family car to suit your new lifestyle.

Separating from your partner

This is another life changing event that not only influences your budget, but could also have a huge impact on your car-buying journey. Whether it’s a roomie who’s immigrating or a long-time girl or boyfriend who cheated on you, you could very suddenly be left with a single income, which means you will be paying for your car repayments, petrol and all the other associated costs yourself.

Fluctuating interest rates

When the interest rate increases, you will pay higher car installments that eat into your budget. Following an interest rate increase you will need to adjust your spending.

Losing your job

The job market is very fickle at the moment – so what happens if you are retrenched? This is definitely something you couldn’t have known or planned for. If you are retrenched and don’t have an insurance policy in place, you are still expected to pay the bills. It’s a very worrying time, but you need to let the bank know immediately before you miss any car payments. When you are upfront the bank can modify your repayment plan to help you afford your installments.

Being a victim of crime or having a serious car accident

As they say, rather be safe than sorry. When you signed your finance contract you promised to have your car comprehensively insured for the unforeseen. This would include events such as a hijacking or a car accident. Any one of these traumatic events could impact your finances, especially if you have cancelled your car insurance. When paying off your car loan, you will need to confirm you are insured comprehensively at least once a year. WesBank has partnered with Hollard and Direct Axis (DA) to confirm the status of its consumers’ insurance on the 12- and 24-month anniversaries of their finance contract..